Do You Pay Vat On Second Hand Goods From Abroad . Value added tax (vat) applies to both sales of goods inside the uk and imports of goods. And what amounts to ‘a business’ for vat. customs duties (sometimes called tariffs) apply only to imported goods. before receiving your goods, you may have to pay vat, customs duty or excise duty if they were sent to: if you buy and receive goods for business purposes from another eu country, you must declare and pay vat on the. check if you need to pay import vat when you import goods into great britain from outside the uk, or outside the eu to. items that are worth under £135 that are purchased from overseas sellers do not incur import vat, but the overseas seller must. as a private individual shopping in the eu, you should only pay vat once, in the country where you make your.

from worldmuslimcongressblog.blogspot.com

if you buy and receive goods for business purposes from another eu country, you must declare and pay vat on the. customs duties (sometimes called tariffs) apply only to imported goods. before receiving your goods, you may have to pay vat, customs duty or excise duty if they were sent to: items that are worth under £135 that are purchased from overseas sellers do not incur import vat, but the overseas seller must. as a private individual shopping in the eu, you should only pay vat once, in the country where you make your. And what amounts to ‘a business’ for vat. Value added tax (vat) applies to both sales of goods inside the uk and imports of goods. check if you need to pay import vat when you import goods into great britain from outside the uk, or outside the eu to.

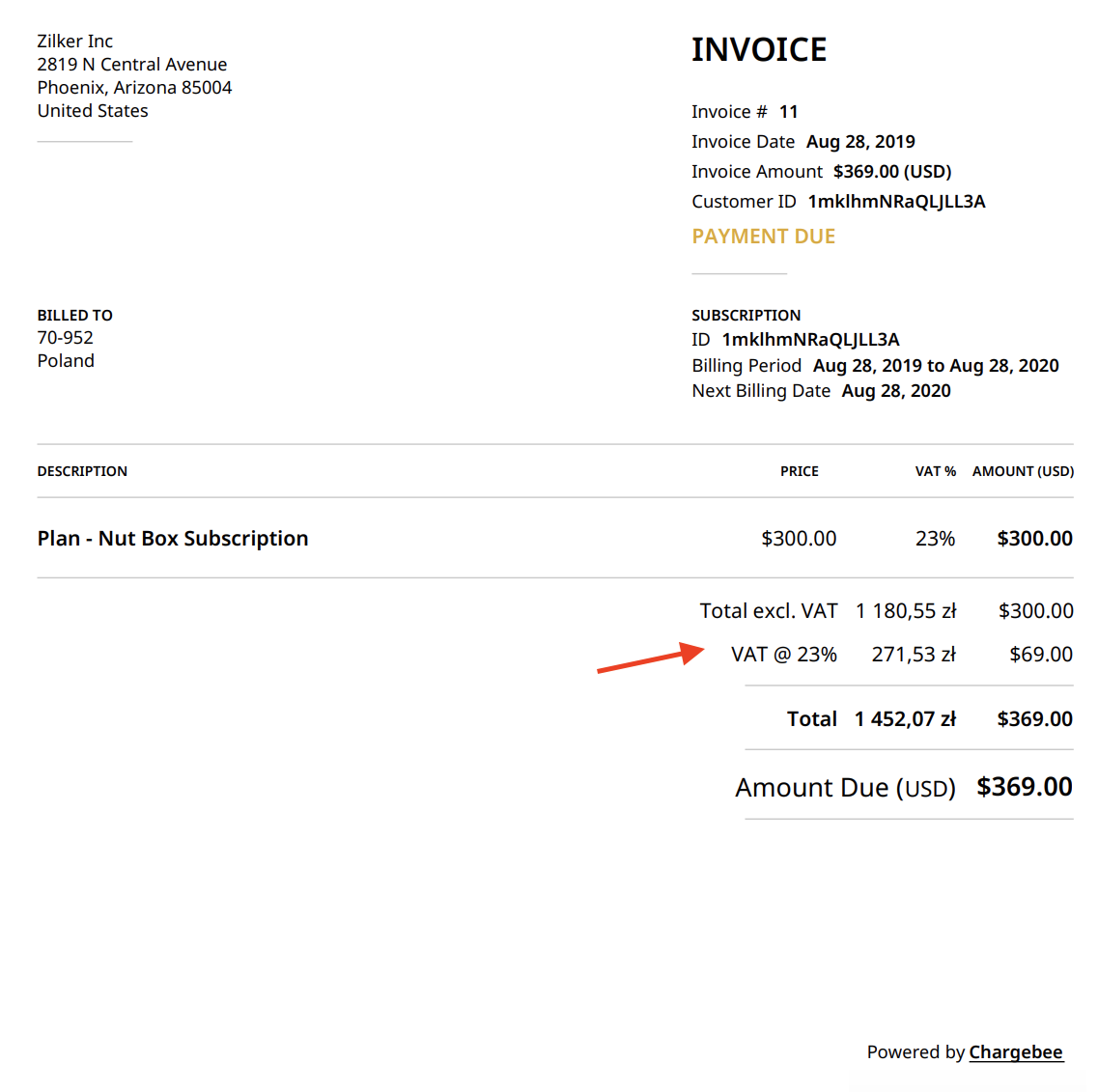

Vat Invoice

Do You Pay Vat On Second Hand Goods From Abroad Value added tax (vat) applies to both sales of goods inside the uk and imports of goods. as a private individual shopping in the eu, you should only pay vat once, in the country where you make your. check if you need to pay import vat when you import goods into great britain from outside the uk, or outside the eu to. Value added tax (vat) applies to both sales of goods inside the uk and imports of goods. items that are worth under £135 that are purchased from overseas sellers do not incur import vat, but the overseas seller must. before receiving your goods, you may have to pay vat, customs duty or excise duty if they were sent to: if you buy and receive goods for business purposes from another eu country, you must declare and pay vat on the. And what amounts to ‘a business’ for vat. customs duties (sometimes called tariffs) apply only to imported goods.

From exochbusz.blob.core.windows.net

Why Do You Have To Pay Vat On Ebay at Jennifer Belli blog Do You Pay Vat On Second Hand Goods From Abroad as a private individual shopping in the eu, you should only pay vat once, in the country where you make your. Value added tax (vat) applies to both sales of goods inside the uk and imports of goods. customs duties (sometimes called tariffs) apply only to imported goods. check if you need to pay import vat when. Do You Pay Vat On Second Hand Goods From Abroad.

From www.playbuzz.com

What items do you pay VAT on? Do You Pay Vat On Second Hand Goods From Abroad Value added tax (vat) applies to both sales of goods inside the uk and imports of goods. before receiving your goods, you may have to pay vat, customs duty or excise duty if they were sent to: And what amounts to ‘a business’ for vat. items that are worth under £135 that are purchased from overseas sellers do. Do You Pay Vat On Second Hand Goods From Abroad.

From exochbusz.blob.core.windows.net

Why Do You Have To Pay Vat On Ebay at Jennifer Belli blog Do You Pay Vat On Second Hand Goods From Abroad And what amounts to ‘a business’ for vat. Value added tax (vat) applies to both sales of goods inside the uk and imports of goods. as a private individual shopping in the eu, you should only pay vat once, in the country where you make your. if you buy and receive goods for business purposes from another eu. Do You Pay Vat On Second Hand Goods From Abroad.

From help.bridallive.com

How to setup VAT(UK) or GST (Australia) BridalLive Do You Pay Vat On Second Hand Goods From Abroad items that are worth under £135 that are purchased from overseas sellers do not incur import vat, but the overseas seller must. check if you need to pay import vat when you import goods into great britain from outside the uk, or outside the eu to. customs duties (sometimes called tariffs) apply only to imported goods. . Do You Pay Vat On Second Hand Goods From Abroad.

From www.scribd.com

VAT 264 Declaration For The Supply of Second Hand Goods External Form Do You Pay Vat On Second Hand Goods From Abroad if you buy and receive goods for business purposes from another eu country, you must declare and pay vat on the. check if you need to pay import vat when you import goods into great britain from outside the uk, or outside the eu to. items that are worth under £135 that are purchased from overseas sellers. Do You Pay Vat On Second Hand Goods From Abroad.

From www.tide.co

What is VAT, how much is it and how much to charge? Tide Business Do You Pay Vat On Second Hand Goods From Abroad customs duties (sometimes called tariffs) apply only to imported goods. check if you need to pay import vat when you import goods into great britain from outside the uk, or outside the eu to. items that are worth under £135 that are purchased from overseas sellers do not incur import vat, but the overseas seller must. . Do You Pay Vat On Second Hand Goods From Abroad.

From accotax.co.uk

What's the difference between exempt items & Zero Rated Vat items? Do You Pay Vat On Second Hand Goods From Abroad Value added tax (vat) applies to both sales of goods inside the uk and imports of goods. And what amounts to ‘a business’ for vat. as a private individual shopping in the eu, you should only pay vat once, in the country where you make your. before receiving your goods, you may have to pay vat, customs duty. Do You Pay Vat On Second Hand Goods From Abroad.

From elevateauditing.com

VAT Services in UAE vat registration services Dubai Do You Pay Vat On Second Hand Goods From Abroad Value added tax (vat) applies to both sales of goods inside the uk and imports of goods. customs duties (sometimes called tariffs) apply only to imported goods. as a private individual shopping in the eu, you should only pay vat once, in the country where you make your. And what amounts to ‘a business’ for vat. if. Do You Pay Vat On Second Hand Goods From Abroad.

From alidropship.com

What Is VAT And Do Dropshippers Have To Pay It? Do You Pay Vat On Second Hand Goods From Abroad And what amounts to ‘a business’ for vat. if you buy and receive goods for business purposes from another eu country, you must declare and pay vat on the. check if you need to pay import vat when you import goods into great britain from outside the uk, or outside the eu to. items that are worth. Do You Pay Vat On Second Hand Goods From Abroad.

From mblaccounting.co.uk

VAT Services Accountancy Services MBL Accounting Do You Pay Vat On Second Hand Goods From Abroad before receiving your goods, you may have to pay vat, customs duty or excise duty if they were sent to: check if you need to pay import vat when you import goods into great britain from outside the uk, or outside the eu to. as a private individual shopping in the eu, you should only pay vat. Do You Pay Vat On Second Hand Goods From Abroad.

From blog.shorts.uk.com

VAT on second hand goods explained Do You Pay Vat On Second Hand Goods From Abroad customs duties (sometimes called tariffs) apply only to imported goods. if you buy and receive goods for business purposes from another eu country, you must declare and pay vat on the. before receiving your goods, you may have to pay vat, customs duty or excise duty if they were sent to: check if you need to. Do You Pay Vat On Second Hand Goods From Abroad.

From www.youtube.com

How to Account for VAT. YouTube Do You Pay Vat On Second Hand Goods From Abroad Value added tax (vat) applies to both sales of goods inside the uk and imports of goods. as a private individual shopping in the eu, you should only pay vat once, in the country where you make your. if you buy and receive goods for business purposes from another eu country, you must declare and pay vat on. Do You Pay Vat On Second Hand Goods From Abroad.

From www.ssoif.co.uk

Do you pay VAT on exports? SSOIF Do You Pay Vat On Second Hand Goods From Abroad as a private individual shopping in the eu, you should only pay vat once, in the country where you make your. customs duties (sometimes called tariffs) apply only to imported goods. items that are worth under £135 that are purchased from overseas sellers do not incur import vat, but the overseas seller must. And what amounts to. Do You Pay Vat On Second Hand Goods From Abroad.

From www.xactauditing.ae

VAT Invoice Format in UAE FTA Tax Invoice Format UAE Do You Pay Vat On Second Hand Goods From Abroad before receiving your goods, you may have to pay vat, customs duty or excise duty if they were sent to: customs duties (sometimes called tariffs) apply only to imported goods. Value added tax (vat) applies to both sales of goods inside the uk and imports of goods. check if you need to pay import vat when you. Do You Pay Vat On Second Hand Goods From Abroad.

From www.accountingfirms.co.uk

VAT on SecondHand Goods Ultimate Guide AccountingFirms Do You Pay Vat On Second Hand Goods From Abroad check if you need to pay import vat when you import goods into great britain from outside the uk, or outside the eu to. And what amounts to ‘a business’ for vat. customs duties (sometimes called tariffs) apply only to imported goods. as a private individual shopping in the eu, you should only pay vat once, in. Do You Pay Vat On Second Hand Goods From Abroad.

From www.deskera.com

VAT Invoice Definition & Rules for VAT Invoicing Do You Pay Vat On Second Hand Goods From Abroad customs duties (sometimes called tariffs) apply only to imported goods. items that are worth under £135 that are purchased from overseas sellers do not incur import vat, but the overseas seller must. And what amounts to ‘a business’ for vat. check if you need to pay import vat when you import goods into great britain from outside. Do You Pay Vat On Second Hand Goods From Abroad.

From www.tide.co

VAT invoice requirements Tide Business Do You Pay Vat On Second Hand Goods From Abroad And what amounts to ‘a business’ for vat. customs duties (sometimes called tariffs) apply only to imported goods. before receiving your goods, you may have to pay vat, customs duty or excise duty if they were sent to: Value added tax (vat) applies to both sales of goods inside the uk and imports of goods. check if. Do You Pay Vat On Second Hand Goods From Abroad.

From www.quaderno.io

What You Must Know About EU VAT If You Have Customers In Europe Quaderno Do You Pay Vat On Second Hand Goods From Abroad if you buy and receive goods for business purposes from another eu country, you must declare and pay vat on the. before receiving your goods, you may have to pay vat, customs duty or excise duty if they were sent to: items that are worth under £135 that are purchased from overseas sellers do not incur import. Do You Pay Vat On Second Hand Goods From Abroad.